One year has seen immense change at Husk Power Systems. Since this essay was first published in the Spring 2018 edition of Demand | ASME’s Global Development Review, Husk has shuttered all of its gasifier-only power plants and forged ahead with solar/gasifier hybrids. The massive consolidation of its assets has not, however, changed its power output. The company provides a collective total of about 2MW of electricity to rural customers in India and Tanzania, with plans to expand to 30MW by 2022.

For a detailed update to this article, please see our interview with Husk’s CEO Manoj Sinha.

Five Questions with Manoj Sinha, CEO of Husk Power Systems

How Husk Power Embraced Adaptability

Husk’s founder shares lessons from a decade of serving the world’s energy poor.

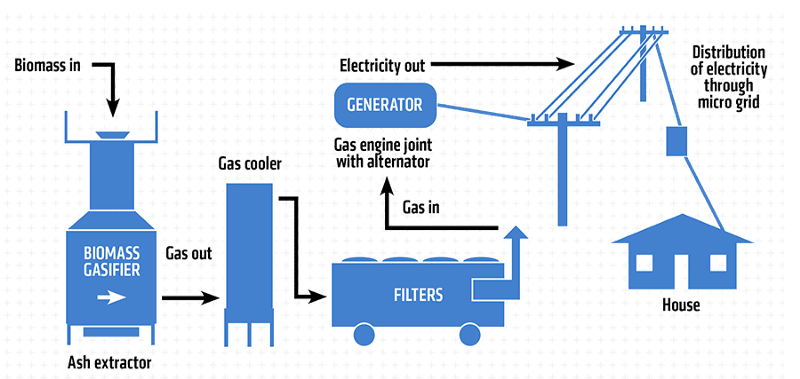

In 2008, customers of the newly founded Husk Power Systems in rural Bihar, India, were content with five to seven hours of electricity each day. The power came on in the evening, turned off sometime in the night and remained off until the next evening. Husk operated a technology that, at the time, seemed poetic: the company generated power by gasifying rice husks, then distributed it to communities in the heart of India’s rice country. The fuel was abundant. In 2008, India produced 148 million metric tons of rice, according to the U.N. Food and Agriculture Organization. Its production volume then (and now) was second only to China.

“We were using our own money to try this method of decentralized electrification. That’s when we came up with this idea of gasification,” says Manoj Sinha, Husk’s CEO. “We used off-the-shelf components, and after trial and error, we figured out this 32-kilowatt system.”

Husk’s idea won the hearts of practitioners in aid organizations, governments, and the media. Its biomass gasifiers powered a network of microgrids that supplied electricity to farming communities disconnected from the national grid. The customers were poor by Western standards. They did not have many uses for electricity other than powering lamps for school children to study by at night; maybe one in ten households had a television.

But it soon became clear that the context in which Husk was founded was changing.

As India’s economy grew, so did people’s expectations. Husk’s customers began to demand 24-hour power. They wanted the same energy standard that many take for granted in the global West: flip a switch and the lights come on. They also wanted more power, because as their incomes grew, Husk’s customers bought more products that required electricity.

Then competition arose from a previously unknown player. India’s government began a push to expand the central grid to rural communities and link up rural homes for the first time. Politicians promising free 24-hour power in the run-up to elections presented a particular threat to the fledgling energy startup.

Around the same time, the market shifted, compounding the consumer and political pressures Husk was facing. The cost of solar technology plummeted, making electricity from photovoltaic panels cheaper than Husk’s gasifiers.

Husk’s founders left the startup one by one, until only Sinha remained of the original crew. The company faced certain doom if it couldn’t evolve to keep up.

“Husk Power was quite the darling of many agencies back in 2010 and 2011, despite what appeared to us even then as a tough business model to scale,” Anand Narayan, an energy access consultant, reflects. “Now, in the last half decade, many things have changed.”

Husk has persevered, however. Rather than flinching away from the threat of solar, Husk appropriated the technology. The company forged strategic partnerships with a solar panel producer and a smart meter startup. It now operates hybrid microgrids that supply solar power by day and rice-husk-power by night.

Rather than flinching from the threat of solar, Husk appropriated the technology and developed a hybrid system.

The new technology allowed Husk to meet the encroaching central grid’s challenge with better service and reliability. Its mini-grids offer 24 hours of electricity, beating the central grid’s standard of six to eight hours in rural India. Many of Husk’s customers have two connections, one to the central grid and one to Husk that carries them through the central grid’s blackouts.

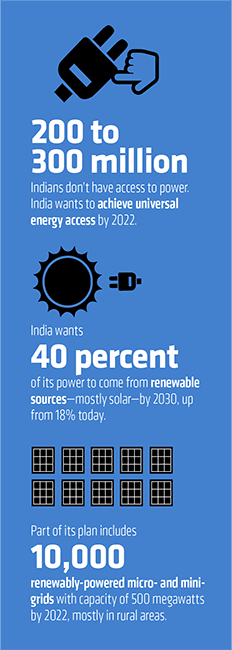

The Indian government has also recently started taking a less competitive stance with decentralized energy providers. With a goal of achieving universal energy access in the country by 2022, the government has made renewably powered microgrids a key part of its plan to bring electricity to the 200 million to 300 million Indians who currently lack power.

Sinha, unsurprisingly, supports that vision. “We believe that mini-grids are the most capital-efficient way to help reach 100 percent national electrification goals,” he said in a recent statement. He told Demand that his commitment to that vision and to Husk’s ability to execute it has enabled Husk to remain relevant throughout a decade of careening social, economic and technological change.

By the numbers

To date, Husk owns and operates 75 minigrids in India and five in Tanzania, according to its website. Most of those are biomass gasifiers and a handful are the company’s newer solar-gasifier hybrid models, though Sinha declined to specify how many.

The two states in India where Husk operates a majority of its plants, Bihar and Uttar Pradesh, are home to a combined total of 350 million people. The company’s decision to expand to Tanzania in 2015 stemmed from the fact that rural off-grid Tanzanian households have similar energy needs to rural off-grid Indian households. Tanzania is less densely populated, however, so each plant serves fewer customers: 150 people per plant in Tanzania versus 205 in India. (The Tanzanian plants also differ in one other way: they consume corn cobs along with rice husks.)

Over the next four years, Husk expects to deploy at least 300 mini-grids in India and Tanzania, thanks largely to a recent US$20 million investment from Shell Technology Ventures, Swedish development finance institution Swedfund International, and French energy company ENGIE’s impact investment fund. Sinha estimates that Husk will build 250 sites in India and 60 to 75 in Tanzania. The build-out is expected to deliver renewable energy to 100,000 customers. Since diesel generators are still a popular power option in off-the-grid communities, Husk has calculated that its plants could also eliminate the burn of 56 million liters of diesel per year.

The global market that Husk plays in offers significant opportunity for expansion. One of the U.N. Sustainable Development Goals calls for universal energy access by 2030. The World Bank estimates that the world is 88 percent of the way there, but with several noteworthy caveats. First, there is a substantial gap between urban and rural access: 97 percent for urban inhabitants, compared to 77 percent for rural inhabitants. Second, those access statistics don’t necessarily mean that people have quality electricity access. Centralized power grids in many countries are notorious for being out more than they are on. And third, the world’s population exceeds the rate at which people are gaining power access.

Country to country, the pace of energy access acceleration also varies considerably. Take Husk’s two existing markets, for example. In India, access has increased from 71.5 percent in 2008 to 84.5 percent in 2016. The access rate in rural India is lower, but it has grown faster, from 62 percent to 77.6 percent over the same period. Tanzania has made significantly greater gains, by comparison, but still has a long way to go. In 2016, 32.8 percent of Tanzanians had electricity access, nearly triple the rate from 2008. In the country’s rural areas, energy access climbed from 2.1 percent in 2008 to 16.9 percent in 2016.

Country to country, the pace of energy access acceleration also varies considerably. Take Husk’s two existing markets, for example. In India, access has increased from 71.5 percent in 2008 to 84.5 percent in 2016. The access rate in rural India is lower, but it has grown faster, from 62 percent to 77.6 percent over the same period. Tanzania has made significantly greater gains, by comparison, but still has a long way to go. In 2016, 32.8 percent of Tanzanians had electricity access, nearly triple the rate from 2008. In the country’s rural areas, energy access climbed from 2.1 percent in 2008 to 16.9 percent in 2016.

Globally, the energy poor pay an enormous price for the heating and lighting sources they do use. “The market size is pretty big: 2.5 billion people spend more than $70 billion annually on energy. That’s on candles, kerosene, etc.” Sinha says.

Not all of the world’s energy poor are based in rural areas, like Husk’s customers. But for those that are, the International Energy Agency notes that “off-grid systems may be the most cost-effective option (from a system cost perspective).”

Husk’s hybrid mini-grids are particularly promising. Much of the past decade’s improvement in rural energy access has been thanks to solar power. Renewable sources of energy accounted for two-thirds of new power globally in 2016, with solar power being the fastest-growing source, according to the International Energy Agency. Solar’s growth “marks a turning point” and it is entering a “new era,” the IEA says in its Renewables 2017 report.

The origins of a startup

For Sinha, who grew up in Bihar, access to energy is a personal issue. “We did have access to electricity, but it was not reliable. My grandparents did not have access at all,” he says.

Sinha left home to study electrical and computer engineering in the U.S., eventually earning a master’s degree from the University of Massachusetts. He designed microprocessors for Intel for six years, then began an MBA program at the University of Virginia. It was in 2007 or early 2008 that he and a few classmates and colleagues began “tinkering with this idea of building small power plants in rural settings.”

“The problem of [un]reliable electricity started bugging me,” Sinha says.

In 2008, solar was too cost prohibitive to use for a solution. Solar equipment cost about $5 to $6 per watt in Bihar at that time. That was more than rural customers in Bihar were willing to pay.

By contrast, rice husks were a low-cost fuel. They were plentiful and mostly unwanted. “We saw that rice husks were just wasted, burned or left to rot,” Sinha says. The team hit on the idea of burning rice husks as fuel and refined the concept to build their first gasifier.

Sinha co-founded Husk with Gyanesh Pandey, an electrical engineer and former classmate; Ratnesh Yadav, who Sinha describes as “a local who knew local stuff, had local contacts, farming expertise and could make things happen”; and Chip Ransler, an American software startup owner who was invited aboard for his business acumen.

The team’s early gasifiers were built to generate 32 kilowatts from 50 kilograms of rice husks per hour. The husks are trucked in from rice mills. Husk pays a small sum for the service and trains and pays local residents to feed the gasifier and monitor electricity usage.

System model of Husk’s original biomass gasification system

The power lines Husk uses to connect households to the power generator run a maximum distance of three kilometers. Any longer than that and they become cost prohibitive.

Husk’s early systems served 8,000 to 9,000 households in about 200 villages. “Because of technical limitations, we produced eight hours of electricity, usually at night. That’s when people used it,” Sinha says. “[There was] no daytime demand because most of the people are farmers.”

But as the economy improved, Husk’s customers wanted more power. “We started noticing that customers who were quite happy with five to seven hours at night [expected] electricity to work all the time. They also began purchasing more appliances. The GDP in India has been going up, so their purchasing power increased. They asked us for 24/7 power on demand. Our existing solution was not enough to meet those needs,” Sinha says.

A necessary evolution

While Husk was searching for a cheap power solution, the cost of solar plummeted. In 2013, solar equipment cost about $1 per watt in Bihar.

Husk hit road bumps on the operational side of the business around that time, too. Until then, the company had been side work for Sinha. After graduating from his MBA program in 2009, he went to work for McGraw Hill Financial. By day, he performed asset and risk management analytics for banks and hedge fund managers on Wall Street, and by night he worked for Husk, raising money and managing relations with investors. Sinha finally quit his job on Wall Street in 2013 and stepped up to Husk’s management team. But by the following year, he was the only remaining founder at the company.

“Slowly, everyone started leaving,” Sinha says. Ransler had left in 2010, then Pandey in 2013, and finally Yadav in 2014. “This business is hard. I’m the lone warrior,” Sinha adds.

To survive, Husk had no choice but to adapt on multiple fronts. Five years after being founded on gasification technology, Husk began a pivot to solar. To make the transition, the company partnered with First Solar, one of the largest solar PV panel manufacturers in the U.S.

That adaptation exemplifies the company’s core vision — to be a rural electrification company — and demonstrates Husk’s agnosticism to the type of technology that helps it achieve the goal.

“When they began, the cost of batteries and PV was high. As the cost of those have come down, Husk incorporated those into its systems,” says Bryan Willson, a professor of mechanical engineering at Colorado State University and founder of the Powerhouse Energy Campus, the energy research lab in Fort Collins, Colorado where Husk is now based.

“It’s still cheaper to provide power at night with gasification than with batteries,” Willson adds. “However, look at the trajectory of PV and batteries. It continues to drop. That would be a challenge [for Husk] if they were a gasification company, but they are a rural electrification company.”

“There’s no magic to building a microgrid. We know how to do it. What we don’t do well is getting it to scale and driving down the cost.”

Husk’s hybrid systems can produce 60 kilowatts of gasifier-plus-solar power, but they operate at about 50 kilowatts. (The gasifier-only systems are still built for 32 kilowatts and operate at 25 kilowatts.) The hybrids supply cheap solar power by day, costlier gasifier power in the evening, and battery power through the night, until solar can kick in again in the morning. This arrangement may be an advantage over solar-only systems with battery backup. As Willson points out, there is no sun during India’s monsoon season.

“To build a solar battery system with enough capacity to provide service in the monsoons, you have to overbuild it. It drives to an uneconomic system,” he says.

Husk’s next technological adaptation was to install smart meters. The company partnered with SparkMeter, a smart metering startup that specializes in mini-grids. The meters allow Husk to monitor how much power each customer uses and to charge up front for consumption. Customers can pay for more power at stores or by phone. (Indian consumers prefer cash, Tanzanians prefer mobile money.) Husk gives a 20 percent discount for power used during the day, from 8am to 4pm.

“We do that pricing to pass on cost savings to customers, and it also promotes productive use of power for businesses,” Sinha says. Businesses can use power to stay open later or operate machinery, for example, while households can employ time-saving tools.

Productive use is important to Sinha. “Our vision is not just to provide electrons, but to provide electricity as a tool so people can use it for productive purposes,” he says. In addition to cost discounts, the company supports this by selling appliances on credit, demonstrating possible uses of power to its customers, and encouraging customers to build small businesses and side jobs around devices like printers, ice cream machines, or water purifiers.

Sinha estimates that his customers’ incomes have increased by 20 to 30 percent with the introduction of 24-hour power. “Anecdotally, the first hybrid plant was installed in October 2015, and by the next May a vendor with a small restaurant was selling 2,000 ice cream bars per day in the summer,” he says. In a region where summer temperatures range between 35 and 40 degrees Celsius, running an ice cream business with intermittent power would be nearly impossible.

Vision and scale

It sounds idealistic — burning rice husks to support ice cream vendors and water coolers in one of the world’s hottest climates. But Husk is a social enterprise founded on a notion that there is a solution to a difficult problem that affects one billion people, so idealism is baked into its core to some extent. The company has proven its pragmatism as well, showing that it is willing to adapt as the world changes around it.

Husk’s adaptability isn’t only reflected in its technology. Late last year, Sinha made the decision to move the company’s headquarters to the Powerhouse in Fort Collins. He works in a small fourth floor office, at a desk that, as of early this year, was still flanked by boxes — the evidence of a recent move.

Fort Collins may seem like an odd move for a startup that operates in India and Tanzania. But Sinha believes it will be a good fit. There is long-term capital available in the U.S., he says, and a growing investor focus on long-term impact. Indeed, the $20 million Husk raised in January is easily among the largest investments in a micro-grid company to date and was all committed by impact-focused investors.

And Husk fits right in at the Powerhouse. The lab is particularly suited to the goals of an energy startup. Half of the center is an abandoned municipal power plant that Willson gave second life to when he founded the research lab in 1992. In the intervening 26 years, the Powerhouse has doubled in size and is now home to Colorado State University’s Energy Institute, which Willson directs. (Willson, by the way, has designed, improved, tested and tinkered with energy technologies that serve people in emerging economies throughout his long career.) As for the Powerhouse’s other tenants, Sinha’s neighbors are other energy startups and social enterprises, including clean-burning stove venture Envirofit, early stage energy venture capital firm Factor(e) Ventures, and XPower, which is another micro-grid enterprise.

“[The Powerhouse is] looking to add value, not only with how we can work with [companies], but in the interactions of the companies themselves,” Willson says. “Xpower and Husk look like competitors, but really they’re synergistic. Husk looks at larger communities, XPower looks at 50 or fewer homes.”

Sinha agrees. “To solve this massive problem, you need a whole ecosystem to reach the goal of impacting as many people as you can,” he says.

His company has certainly succeeded in galvanizing the ecosystem’s support recently. At the time of Husk’s recent investment announcement, the company’s investors expressed a shared optimism that Husk and other decentralized energy players would become a force in achieving universal energy access.

Brian Davis, vice president of integrated energy solutions for Shell’s New Energies business, said: “We believe that decentralized solutions will play an important role in providing productive energy to customers who currently lack reliable power.”

Gerth Svensson, CEO of Swedfund, gave the slightly more measured opinion that the private sector plays a central role in the electrification of rural communities in developing countries.

And Anne Chassagnette, vice president of ENGIE Rassembleurs d’Energies, called Husk’s business model “highly efficient and replicable.”

What has allowed Husk to get to this point is its team’s experience and learning what not to do along the way.

“There’s no magic to building a micro-grid. We know how to do it. What we don’t do well is getting it to scale and driving down the cost,” Willson says. “The [Husk] team has developed a solution that works now. They have a vision to get to scale and to continue with product and process improvements as technology evolves.”

Hundreds of organizations around the world have taken a grant and built a mini-grid, but they aren’t providing power to millions. Maybe Husk will.