Agriculture

August 20, 2024

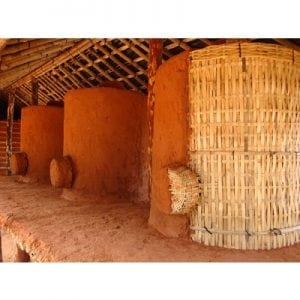

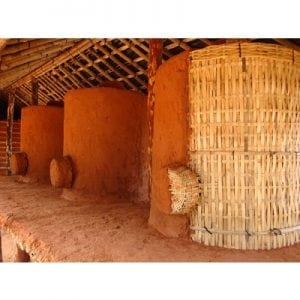

Zero Emission Fridge for Rural Africa (ZEFRA)

Read SolutionImplemented by

HELVETAS Swiss Intercooperation

Updated on June 11, 2024

·Created on July 18, 2019

ACRE Africa Weather Index Covers is a weather based index insurance program for smallholder farmers using mobile technologies.

ACRE Africa Weather Index Covers is the the largest agricultural insurance program in Africa and the first agricultural insurance program worldwide to reach smallholders using mobile technologies. It pays out benefits on the basis of a predetermined index (e.g. rainfall level) or loss of assets and investments resulting from weather and catastrophic events, without requiring the traditional services of insurance claims assessors.

Target SDGs

SDG 2: Zero Hunger

SDG 1: No Poverty

Target Users (Target Impact Group)

Household, NGOs

Distributors / Implementing Organizations

The initial project Kilimo Salama was funded by Syngenta Foundation, and later evolved to a for profit company ACRE (Agriculture and Climate Risk Enterprise Ltd.).

Countries

Kenya, Rwanda, Tanzania

Manufacturing/Building Method

N/A

Intellectural Property Type

Trade Secret

User Provision Model

Users can obtain the service by contacting ACRE Africa. Smallholder farmers need to provide physical location, acreage and the risks they would like to cover.

Distributions to Date Status

Cumulatively estimated 1.7mil to have been served across the target regions

Telecommunication service required

2G

Device(s) required

Mobile phone

Level of connection service needed

SMS

Permanent network connectivity required (Y/N)

No

Usage rate (%)

Farmers receive their index insurance policy numbers and premium receipts via SMS, and payouts are sent electronically via M-PESA.

Additional features required

M-PESA

Two way communication (Y/N)

No

Literacy support (Y(specify) / N)

No

Languages available

Product leaflets/fliers are available in English, Swahili and Nyarwanda.

Operating system and version

N/A

Power requirements

N/A

eAgriculture application

Index insurance

Design Specifications

Mobile phone technology is essential for the service. M-PESA mobile banking system keeps index insurance premiums affordable for smallholder farmers. Farmers receive their index insurance policy numbers and premium receipts via SMS, and payouts likewise are sent electronically via M-PESA.

The farmer is provided with a term sheet that indicates the technical features of the product indicating the parameters to be used to trigger a loss per crop stage. i.e the rainfall level that indicates a loss at either germination, vegetation, flowering, and maturity (dry down). Interview with representative

The farmer enters a unique code to register for insurance. ACRE Africa monitors the weather at the farmer’s location. An insurance payment is triggered if the weather index indicates the occurrence of adverse weather conditions at the germination phase.

Technical Support

Users can contact the manufacturer.

Replacement Components

N/A

Lifecycle

N/A

Manufacturer Specified Performance Parameters

Reduce the risk from adverse weather and thereby provide a safety net for farmers, promoting increased agricultural investment and improved livelihood

Vetted Performance Status

Syngenta claims that insured farmers earned 16% more income compared to their uninsured counterparts.

Safety

N/A

Complementary Technical Systems

M-PESA

Academic Research and References

Sibiko K.W., Veettil P.C. and Qaim M., 2018, Small Farmers’ Preferences for Weather Index Insurance: Insights from Kenya, Agriculture & Food Security, 7(53).

Greatrex H., Hansen J., Garvin S., Diro R., Blakeley S., Le Guen M., Rao K., and Osgood D., 2015, Scaling up Index Insurance for Smallholder Farmers: Recent Evidence and Insights, Climate Change, Agriculture and Food Security, CCAFS Report No. 14, Copenhagen: CGIAR Research Program on Climate Change, Agriculture and Food Security (CCAFS).

Wairimu E., Obare G. and Odendo M., 2016, Factors Affecting Weather Index-based Crop Insurance in Laikipia County, Kenya, Journal of Agricultural Extension and Rural Development, 8(7), pp. 111-121.

Tadesse M.A., Shiferaw B.A. and Erenstein O., 2015, Weather Index Insurance for Managing Drought Risk in Smallholder Agriculture: Lessons and Policy Implications for Sub-Saharan Africa, Agricultural and Food Economics, 3(26).

Sibiko, K. W., and Qaim, M., 2017, Weather Index Insurance, Agricultural Input Use, and Crop Productivity in Kenya, Global Food Discussion Papers, 94.

Johnson, L., 2013, Index Insurance and the Articulation of Risk-Bearing Subjects, Environment and Planning A: Economy and Space, 45(11), pp. 2663-2681.

Carter, M., de Janvry, A., Sadoulet, E. and Sarris, A., 2017, Index Insurance for Developing Country Agriculture: a Reassessment, Annual Review of Resource Economics, 9, pp. 421-438.

Ntukamazina, N., Onwonga, R. N., Sommer, R., Rubyogo, J. C., Mukankusi, C. M., Mburu, J., and Kariuki, R., 2017, Index-based Agricultural Insurance Products: Challenges, Opportunities and Prospects for Uptake in sub-Sahara Africa, Journal of Agriculture and Rural Development in the Tropics and Subtropics, 118(2), pp. 171–185.

Hansen, J., Rose, A., and Hellin, J., 2017, Prospects for Scaling up the Contribution of Index Insurance to Smallholder Adaptation to Climate Risk, CCAFS Info Note.

“Syngenta Foundation for Sustainable Agriculture.” n.d. The Syngenta Foundation for Sustainable Agriculture. Accessed June 11, 2024. https://www.syngentafoundation.org/

“ACRE Africa – Building Farmer Resilience.” 2020. ACRE Africa. June 18, 2020. https://acreafrica.com/

“Contact Us.” 2020. ACRE Africa. August 17, 2020. https://acreafrica.com/contact-us/

“Goal 2.” n.d. Sdgs.Un.Org. Accessed June 11, 2024. https://sdgs.un.org/goals/goal2

“ACRE Africa: Protecting Rural Africa Through Creative Partnerships and Technology.” 2020. Index Insurance Forum. January 28, 2020. https://www.indexinsuranceforum.org/news/acre-africa-protecting-rural-africa-through-creative-partnerships-and-technology

Tadesse, Million A., Bekele A. Shiferaw, and Olaf Erenstein. 2015. “Weather Index Insurance for Managing Drought Risk in Smallholder Agriculture: https://agrifoodecon.springeropen.com/articles/10.1186/s40100-015-0044-3

User, Super. n.d. “M-PESA GO.” Safaricom.Co.Ke. Accessed June 11, 2024. https://www.safaricom.co.ke/main-mpesa/m-pesa-services/m-pesa-go

Compliance with regulations

Unknown

Evaluation methods

Evaluated for size of loan portfolio to farmers and index insurance premium income (data from 2011)

Other Information

None

Agriculture

August 20, 2024

Implemented by

HELVETAS Swiss Intercooperation

Agriculture

June 11, 2024

Implemented by

6th Grain

Agriculture

August 29, 2024

Implemented by

Futurepump Ltd.

Agriculture

August 20, 2024

Implemented by

Technology for Tomorrow (T4T) Africa

Agriculture

January 22, 2024

Implemented by

Proximity Designs

Agriculture

January 6, 2025

Implemented by

Agribotix

Agriculture

September 10, 2024

Implemented by

Full Belly Project

Agriculture

January 6, 2025

Implemented by

Microsoft

Agriculture

August 21, 2024

Implemented by

Marius Rossouw design engineer Aflastop

Agriculture

September 19, 2024

Implemented by

Hydroponics Africa

Have thoughts on how we can improve?

Give Us Feedback